A Simple Guide for Everyday Investors

One of the best ways to reduce risk and still build wealth over time is by creating a diversified investment portfolio. This simple but powerful approach helps you spread your money across different types of investments so that you are not depending on just one thing to succeed.

A diversified investment portfolio is important for anyone who wants stable, long-term financial growth. In this article, we will break down what a diversified investment portfolio means, why it matters, and how you can build one even if you’re just starting out.

What Is a Diversified Investment Portfolio?

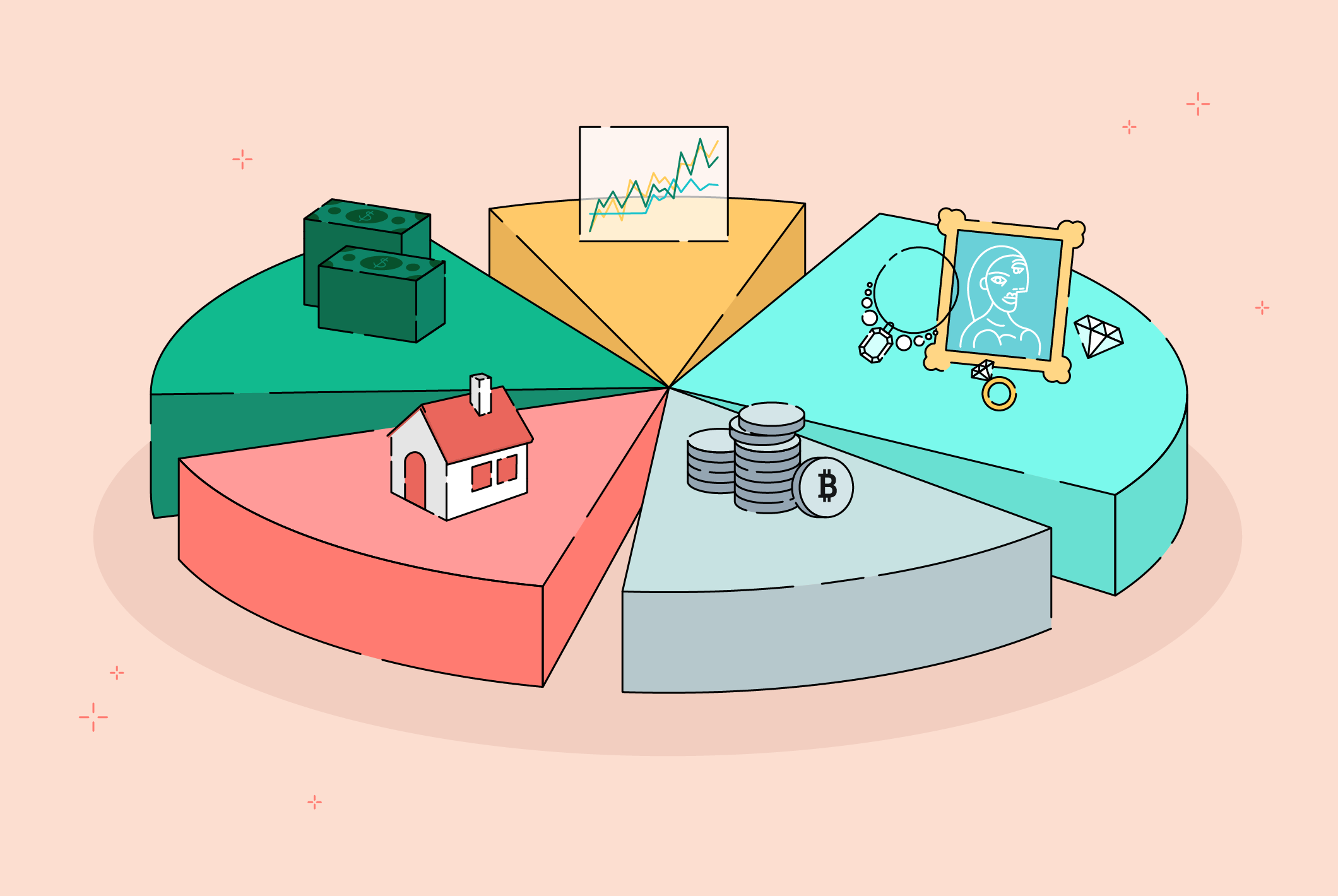

A diversified investment portfolio is a mix of different investment types. Instead of putting all your money into one asset, like only stocks or only real estate, you spread your funds across different options. The goal is to reduce risk while increasing your chances of earning steady returns.

For example, a diversified investment portfolio may include:

- Stocks

- Bonds

- Real estate

- Mutual funds

- Exchange-Traded Funds (ETFs)

- Cash or savings

- Commodities like gold

By having a variety of investments, your money is not tied to the performance of just one sector. If one investment performs poorly, others in your diversified investment portfolio may perform well and balance things out.

Why You Need a Diversified Investment Portfolio

1. It Reduces Risk

The biggest reason to have a diversified investment portfolio is protection. Every type of investment comes with its own risks. Stocks may grow quickly but can drop during market changes. Bonds may be stable but may offer lower returns.

With a diversified investment portfolio, you avoid the danger of “putting all your eggs in one basket.” If one part fails, your entire financial future doesn’t fall with it.

2. It Helps You Earn More Over Time

Different investments grow at different rates. Some rise slowly, while others grow quickly. A diversified investment portfolio helps you enjoy the benefits of both. You get the fast growth of high-risk assets and the steady returns of low-risk assets.

3. It Protects You From Market Changes

Markets go up and down. Sometimes stocks perform well; other times real estate becomes more valuable. A diversified investment portfolio helps you stay protected no matter how the market shifts.

How to Build a Diversified Investment Portfolio

1. Understand Your Financial Goals

Before creating a diversified investment portfolio, think about what you want to achieve. Are you saving for retirement, building wealth, or preparing for your children’s education? Your goals determine the mix of investments you need.

2. Assess Your Risk Level

Your comfort with risk determines how your diversified investment portfolio should be structured.

- If you prefer safety, you may choose more bonds and stable assets.

- If you want fast growth, you may choose more stocks or high-risk investments.

3. Mix Different Types of Assets

A strong diversified investment portfolio includes assets from various categories:

- Stocks for growth

- Bonds for stability

- Real estate for long-term value

- Cash for flexibility

- ETFs or mutual funds for easy diversification

4. Review and Adjust Regularly

A diversified investment portfolio is not something you set once and forget. Review it at least once a year. If one investment is becoming too large or too risky, you can adjust the balance.

A diversified investment portfolio is one of the smartest ways to protect your money and grow your wealth steadily. It spreads your risk, balances your returns, and helps you stay strong even when the market changes. Whether you are a beginner or an experienced investor, building a diversified investment portfolio can set you on the right path to long-term financial success.