More in News

-

Lifestyle

Get Ready To Embrace The Future: The 2025 Ahiajoku Annual Lecture Is Here!

Mark your calendars for an unforgettable experience as brilliant Igbo minds from seven states will converge...

-

Living

Tuesday of week 33 in Ordinary Time

2 Maccabees 6:18-31Psalm 3:2-7Luke 19:1-10 WHEN YOUR FAITH IS SEEKING UNDERSTANDING, GOD TAKES IT TO A...

-

News

BOT Member Announces Upcoming Resolution For PDP Rift

Alhaji Fasiu Bakene, a member of the Peoples Democratic Party Board of Trustees (BOT), has promised...

-

Entertainment

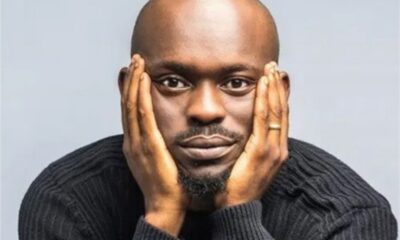

Mr. Jollof Issues Apology Following Dispute With VeryDarkMan

Comedian Freedom Atsepoyi, better known by his stage as Mr. Jollof, has expressed regret for his...

-

Gists

Ned Nwoko Declares He Doesn’t Want Regina Daniels Back

Senator Ned Nwoko of Nigeria has declared that he is not interested in welcoming Regina Daniels,...