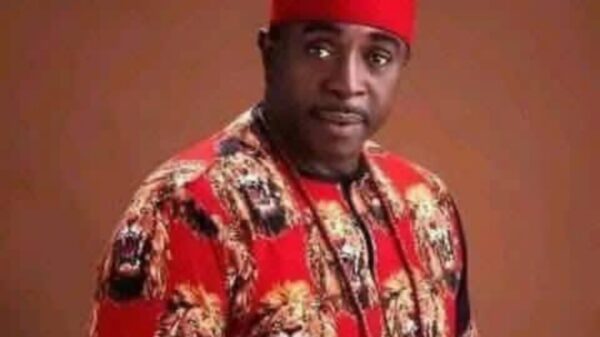

The plea came from founder of Agusto & Co – a credit rating agency – Bode Agusto while speaking at a webinar on Monday titled: “Nigeria in 2022 – Will 2022 Be a Year of Strong Growth Driven by Herd Immunity from COVID-19?”

According to him, one way to reduce the pressure in the foreign exchange (forex) market was for the CBN to resume the sales of dollars to Bureau De Change (BDC) operators.

Mr Agusto also projected that if the CBN maintained its current stand not to sell dollars directly to the BDC operators, the naira to dollar exchange rate would depreciate to N620/$1 in the parallel market before the end of 2022.

Mr Agusto stated that the naira would continue to suffer in the parallel market if additional liquidity was not brought into the market through the BDCs.

He said, “We see continued pressure on the parallel market exchange rates.

And the only way to reduce pressure in the parallel market is to throw money thereby selling dollars to the BDCs. If there is no additional funding to the BDCs from the CBN then the parallel market rate will be between N610 and N620 in 2022. It will be fueled by scarcity and the difference between inflation rates of the dollar and the Naira.”

He also predicted that the much-anticipated rate convergence in the foreign exchange market would take longer than expected since the central bank would be hell-bent on pegging the official rate.

He stated that convergence would make Nigeria have a single exchange rate, where the parallel market premium was less than 3.0 per cent of the official rate.

Speaking on Nigeria’s growing debts, Agusto said: “The federal government says ‘we don’t have a debt problem and that we have a revenue problem.’ But I disagree completely. We have a debt problem that we are not taking very seriously; we are taking it lightly.”

Recall that at the Monetary Policy Committee (MPC) meeting on Tuesday, July 27, 2021, the CBN hit the BDCs for illegal forex trading and stated that it would henceforth discontinue the sales of forex to the operators in the country.

The CBN Governor, Godwin Emefiele, also announced a halt to the licensing of new BDC operators and further processing of BDC applications for forex across the country.