Kogi State has announced implementation of the Nigeria Tax Act 2025, from January 1, aiming to simplify compliance

Ahead of commencement of the new tax administration in the country, the Kogi State Government has disclosed the state is set to domesticate Nigeria’s new Tax Act 2025 which will be implemented in the state by the Kogi State Internal Revenue Service (KGIRS) as from January 1st, 2026.

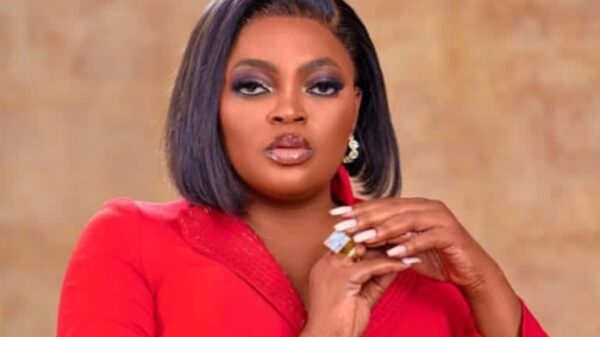

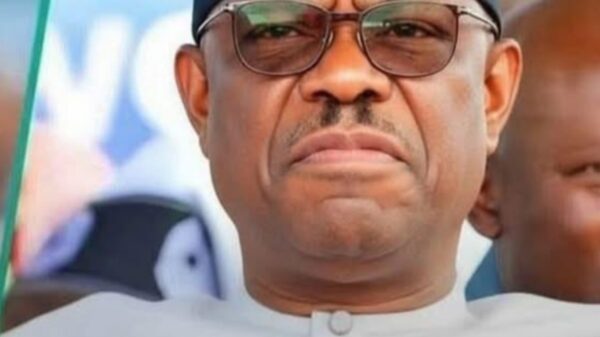

The state governor, Usman Ododo made this known while speaking at the opening ceremony of the stakeholders meeting with the theme Understanding Nigeria’s Tax Act 2025 held in Lokoja on Thursday.

Ododo expressed appreciation at the presence of the Chairman of the Kogi State Internal Revenue Service, the Directors of Finance of various Ministries, Departments, and Agencies (MDAs), and all distinguished participants. Your presence clearly demonstrates a shared commitment to strengthening tax administration and promoting voluntary compliance across Kogi State.

The governor, represented by the Special Adviser on Tax, Rahman Ichanyi, explained that good governance and economic reforms continues to enhance fiscal discipline and sustainable development in the state.

The governor also lauded the management and staff of KGIRS for their professionalism, dedication, and proactive engagement with stakeholders.

This sensitization exercise reflects their resolve to ensure clarity, transparency, and inclusiveness in the implementation of the new tax framework.

“The 2025 Tax Acts, that will be domesticated by Kogi State, is distinguished by its simplicity, clarity, and taxpayer-friendly provision.

“It harmonizes tax obligations, removes incidences of multiple taxation, and provides clear guidelines that make compliance easier for taxpayers.

“The law also embraces technology-driven processes that improve efficiency, reduce human interference, and promote accountability.

“Furthermore, the domesticated tax Acts will offer significant benefits to taxpayers by reducing compliance costs, ensuring fairness and equity, and fostering a more predictable and business-friendly tax environment.

“Ultimately, it strengthens the trust between government and taxpayers and ensures that revenues generated translate into improved public services and infrastructural development across the state.”

Ododo also urged all MDAs and stakeholders to support the effective implementation of the 2025 Tax Acts that will be domesticated in Kogi State and to serve as ambassadors of compliance within their respective institutions. Together, we can build a robust and sustainable revenue system that will drive inclusive growth and development for Kogi State.