Mastering financial management at home is essential for ensuring both the present and future financial stability of a household.

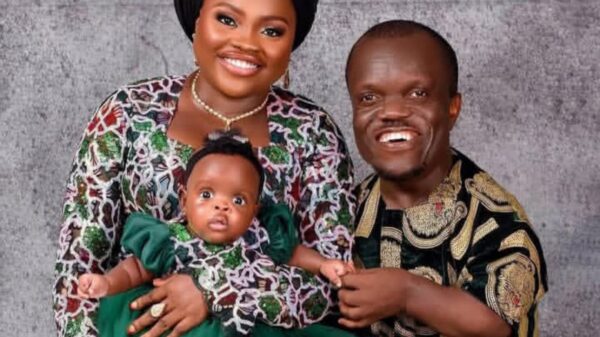

It is a vital skill for every mother, enabling her to meet immediate family needs while building a secure future.

Additionally, financial management is crucial due to the responsibilities mothers bear in ensuring that the home runs smoothly and everyone has what they need.

As women often have significant purchasing power, mastering financial management becomes even more important.

This article will highlight the importance of financial management at home, focusing on budgeting, saving, and setting financial goals. These steps are critical in building the financial stability of the family.

Without proper budgeting and saving, continuous spending and increased financial demands on a husband can diminish the savings potential of both partners, ultimately affecting the household’s long-term financial health.

To manage finances effectively, it is essential for mothers to:

1)Understand the Financial Health of the Home:

This can be achieved through the following steps:

i) Track All Sources of Income: Begin by identifying all sources of household income.

ii)Categorize Expenses: Group household expenses to identify patterns and areas of unnecessary spending.

iii)Reallocate Resources: Use the insights from tracking and categorization to reallocate funds toward important needs, savings, and investments.

This brings about financial awareness, and thus provides clarity and confidence in decision-making, helping to eliminate wasteful spending and prioritize essential areas.

2)Creating a Family Budget: A well-structured budget is a cornerstone of effective financial management. Here’s how to create and maintain one:

i)List All Sources of Income: Clearly document all household earnings.

ii)Identify Fixed Expenses: Include items such as rent, utilities, and food.

iii)Allocate for Savings and Investments: Set aside a portion of income for future needs and growth.

iv)Plan for Discretionary Spending: Include flexible spending to accommodate the family’s priorities.

A good budget should reflect the family’s goals and be adaptable to changes over time. For a secure and prosperous financial future, mastering financial management is essential.

For more updates on this, kindly follow our social media page.