The management of AG Mortgage Bank PLC has disclosed that the Nigerian housing sector was contributing above N11 trillion to the Gross Domestic Product, GDP, by year 2024.

Quoting the Nigerian Bureau of Statistics, NBS, the Mortgage Bank stated that despite this laudable achievement, Nigerian housing deficit remains estimated in excess of 28 million units.

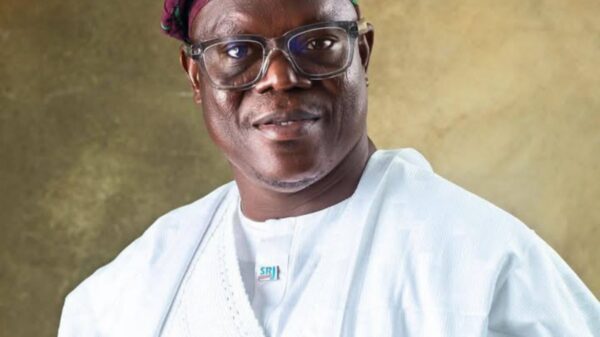

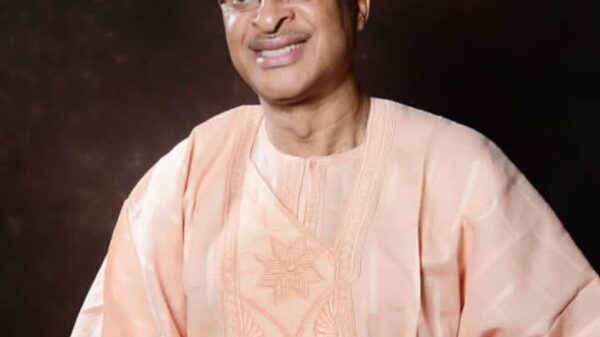

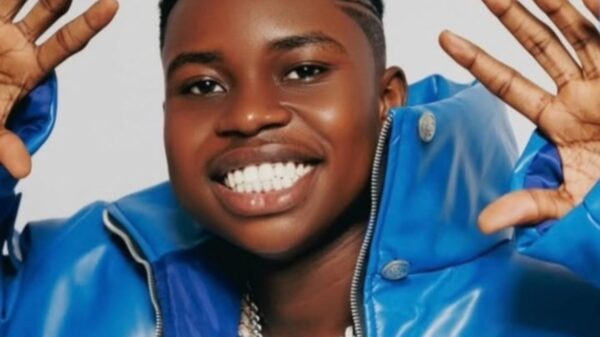

Chairman of the organisation’s Board of Directors, Felix Nwabuko announced this at the 2024 Mortgage Bank PLC Annual Report and Accounts 20 years Anniversary in Abuja.

He said the federal government’s Renewed Hope Agenda gained momentum in 2024 with renewed emphasis on affordable housing delivery, housing finance reform, land tilting and enhanced collaboration with private sector stakeholders.

According to him, “AG Mortgage Bank PLC continues to play a strategic role in supporting these national housing efforts. The policy that allows retirement savings accounts (RSA) Holden’s to access 25% of their pension balances for home equity contributions witnessed higher adoption in 2024. This initiative has continued to narrow the gap in housing financing in Nigeria.

“The bank is one of the leading administrators of RSA linked mortgages, helping more Nigerians transition from tenants to home owners. The Help to Own initiative of the Family Homes Fund, FHF, which is gradually inching mortgage rates closer to a single digit rate is a very welcome development.

“The bank is one of the first active players in the scheme amongst the primary mortgage banks in Nigeria, and will continue to do so, blending it with its internal mortgage facilities”.

He named challenges in the mortgage ecosystem to include dearth of accessibility long term capital, limited availability of low-cost housing stock, rising construction cost, legal delays in foreclosure processes and deficiencies in the land administration system.

To unlock scale, our industry must continue pushing for digitised land registries, capital market integration, credit enhancement and regulatory easing.

Nwabuko also noted that the mortgage sub-sector needs to consolidate and scale, as all signs are pointing to the inevitability of consolidation, but a leading company will in some way need to emerge with the scale and internal innovation capability and strength to create leading products and drive some acquisitions or scale by organic growth.